Exhausted by Day Trading and Option Trading?? and Thinking about Swing Trading? If yes, then read this short blog about the same. It will take nearly 4 minutes of time to read.

Table of Contents

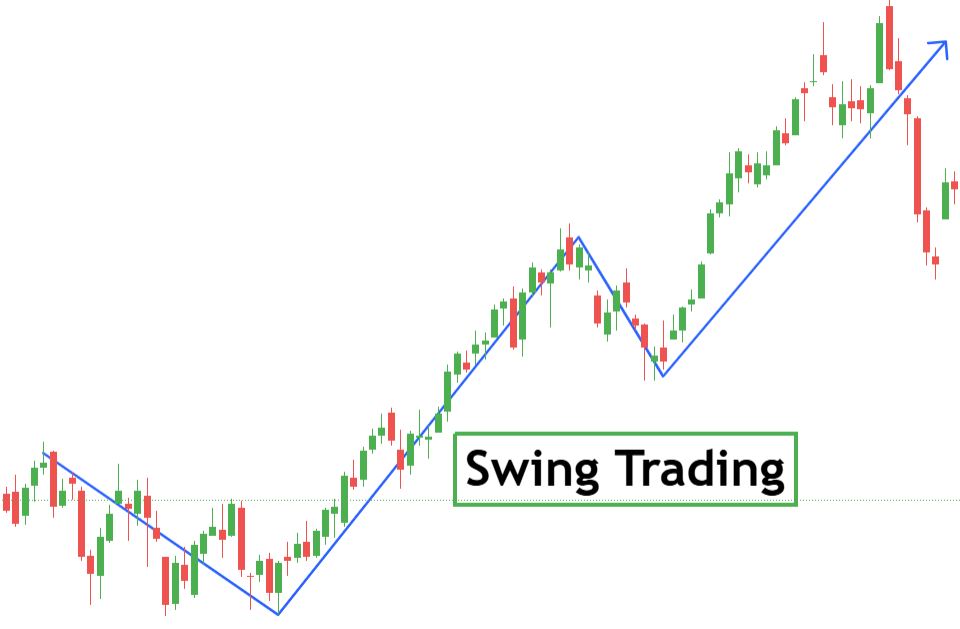

Swing Trading

It is the way to trade the markets (stocks, commodities or any other financial instruments) when there’s a possibility of price movement in a particular direction. The time period of investment is ranging from a few days to several weeks. As swing trader is focusing on capturing the trend for that he/she will keep invested during the trend, at the end of trend or when the instrument’s price gets into consolidation or instrument gets into the opposite trend then the trader will exit the position by booking the profit or loss. Swing trading mainly uses technical analysis to enter or exit from the trade.

Key Characteristics of Swing Trading

- Time Span: Swing trades held for a few days to several weeks to capture short to medium term price movements.

- Tools:

- Technical indicators like Moving Averages, RSI, MACD, Support and Resistance, Supertrend, Bollinger Bands, volume etc.To succeed in swing trading, mastering technical analysis is crucial. For an in-depth look at technical indicators, check out this resource on popular trading indicators.

- Chart Patterns like Double tops and Double bottoms, Head and Shoulders, Triangles, Flags and Pennants etc.

- Support and Resistance can be used for entry, exit or stop-loss.

- Candlestick Patterns like Dohi, Hammer, Engulfing for entry and exit.

- Trendlines are useful to identify the market trend.

- Risk-Reward Ratio: The swing trader will target minimum 2:1 (Reward:Risk) but depending on market conditions traders can target up to 3:1 or 4:1.

Important Points

- Market Selection: For Swing Trading, Traders need to focus on liquid markets and stocks with sufficient volatility for meaningful price swings.

- Position Sizing:Use position-sizing techniques to manage exposure and prevent large losses.

- Flexibility in Both Directions:Swing traders can take both long and short positions (in case of F&O) based on market trends.

- Time Commitment:Traders need moderate time investment, with daily or weekly analysis of charts.

- News and Events: With primarily technical analysis, swing traders are also required to monitor news events (earnings reports, economic data) that could impact price movements.

- Stop-Loss and Take-Profit Orders:To be profitable it is essential to limit losses and as well as lock gains so techniques like trailing stop-loss are used.

- Psychological Discipline:Most Important factors that are required for success are patience, consistency, and emotional control to stick to the trading plan.

Advantages of Swing Trading

- Requires less time as compared to day traders.

- Have more time to rethink about the position taken which will result in less psychological pressure.

- Less number of trades will reduce the frequency of trades and ultimately charges

- It will reduce the holding time as the swing trader is trying to enter at the start of swing and exit at the end of trend.

- Requires less focus on fundamentals of selected stock but one should not enter blindly by observing charts only.

Challenges of Swing Trading

- As swing traders are giving more importance to chart it may lead to entry into manipulated stocks.

- Swing traders are prone to overnight and weekend risks of gap-up and gap-downs.

- Sudden market reversal may lead to larger losses.

- Swing traders may miss long term trends as his main focus is on capturing short term moves in markets.

Conclusion

Swing trading is the best way to capture short term moves and increase the returns on investments. But this will require discipline, consistency, and emotional control to take entry in selected stocks without fear and exit at a decided target (from correctly entered stocks) or stop loss (from wrongly entered stocks by accepting the loss). If one can follow the swing trading strategy with discipline and consistency without greed and fear then “Swing is King”.

Stocks for Swing Trading

Few stocks for Swing Trading for study can be accessed by using link given below.